Yodaa – A Neo-bank for Teens – Launched in India

-

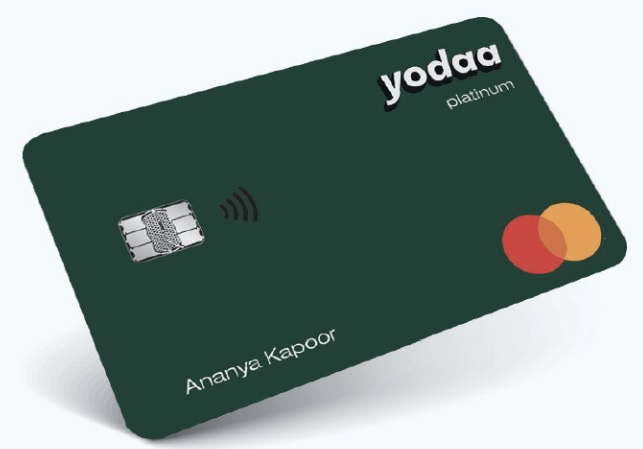

Yodaa offers teens a personal card and app to manage their finances.

-

Yodaa intends to raise a generation of financially aware teenagers for the new decade.

-

The app allows parents to transfer money digitally to their child’s card, get spend notifications, and set budgets

-

The Yodaa app allows teen users to make peer-to-peer payments within its network, get spend insights, and access curated learning resources to better understand personalfinance

-

Yodaa is the first teen-banking product launched by Singapore-based Atlantis

Yodaa, a neo-bank and lifestyle app for teenagers, is launching in India. Designed to be the best thing to happen to teenagers since getting access to their personal smartphone, Yodaa strives to be the fabric that connects financial well being, opportunity creation, and empowerment for teens. It goes beyond being a transactional finance app by being a platform that educates teens on aspects of money not taught by the education system, and unlocks the potential to live the lifestyle they deserve.

|

Yodaa provides teen users a card and an app. The card allows them to make purchases online and in stores and the app connects the teen’s card to that of a parent. The app also allows teens to make peer-to-peer payments to other Yodaa users, split bills, set up recurring savings plans, and access curated learning resources on personal finance. Parents can use the app to top up their child’s card, contribute to their savings, get spending notifications and insights, and set budgets.

|

Yodaa is designed to empower the younger generation by giving them the tools needed to become responsible adults with a better awareness of personal finance.

Yodaa.Club is a part of Atlantis, a financial technology company started by Gaurav Sharma, a serial entrepreneur and respected member of the global fintech community. The founding & operating team of Atlantis comprises serial entrepreneurs and professionals from banking, financial tech & consumer internet industries.

“Money management and good financial behaviour is largely neglected in our society and most people are left to fend for themselves as adults without the knowledge of how to build wealth.We intend to raise a generation of financially aware teenagers for the new decade. Yodaa will fundamentally change the dynamics of how our users view personal finance, and how they attain financial independence,“ Sharma said.

Yodaa is currently invite-only, and is rolling out in India, with a release in the Southeast Asia market planned later this year. “The demand for invites has been great,” Sharma added, “With the technology ecosystem evolving fast, young consumers need a product that trusts them with money, helps them in seamless transactions at merchants, and builds their confidence in creating a pool of money for the future. It also gradually builds up their knowledge about financial services.” While Yodaa seeks to redefine the way users bank, it still follows the first principles of trust, security, privacy, and safety associated with any leading bank.

About Atlantis

Atlantis, headquartered in Singapore, is building a ‘Bank of the Future‘ for the AI-first world. Atlantis is committed to empower, enable opportunity creation, and advance the financial well-being of our community through transparent and responsible product offerings.

Atlantis is launching two products for GenZ and Millennials in India: Yodaa and NEO.

This content comes to you under an arrangement with NewsVoir. Source